Should I Accept Credit Cards?

This is a question that comes up from Clients and prospective Clients ALL the time, so I thought I’d write up my usual answers in case it’s useful to you, small business owner. Please keep in mind that you may still want to check with your tax preparer/counsel on this subject to sort out any nuances based on where you do business.

First off, the Pros.

Accepting credit cards can make it easy/quicker for people to pay you.

Generally I’m in favor of anything that makes it easy/easier for your customers to pay you. Anything that shortens the time between when you’ve delivered your product or service and when you have your money is a Plus.*

Accepting credit cards can make cash available to you faster.

Yessss, some people prefer to write you a check, which typically (even if they use their bank’s online Bill Pay option) means delivery of that check into your hands depends on the postal service.

Accepting credit cards means an end to bounced checks and waiting periods to access your cash.

Yes, nowadays, you can deposit checks from your bank’s mobile app on your phone, thank goodness, which eliminates the errand of visiting a branch in person. BUT checks still carry the potential that there will be insufficient funds in the account. In addition, funds from personal checks are typically not immediately available to you to spend once you’ve deposited them, adding yet another delay.

And now, the Cons. Well, really there’s just one.

Accepting credit cards is going to cost you something.

The primary resistance to accepting credit cards that most business owners identify is the merchant fee, generally about 3.5%. On a $10,000 invoice, that’s $350, not nothing.

So what’s the number one question people ask me about merchant fees?

Can I charge clients for accepting credit card payments?

It depends. There are some state-level regulations on this – there are nuances about the words you can/can’t use, and limitations on how much of a credit card fee you can add to a transaction. That said, many of us have patronized small businesses where there’s a sign at the register letting us know there’s an additional fee for payment via credit card or that cash payments get an equivalent discount. Most of the time as consumers, we’re not put off by that, as long as the transaction – and consequently, the additional fee – is relatively small.

But should I?

Ah, this is the real question. It’s up to you, ultimately, to decide whether to do so, whether adding a fee will put off your customers, whether the trade-off of the merchant fee for the speed of cash access is worth it to you.

I am of the opinion that you’re better served to ensure your prices can absorb a 3.5% merchant fee and/or to allow credit card payment selectively. In some cases, it makes sense to allow payment by credit card for smaller invoices (and “smaller” is relative, and subject to the Client’s own comfort level) or in certain cases, accepting that the merchant fee is a cost of doing business. There are other options for quicker payment – see next.

Are there alternatives to credit cards that shorten wait time to get paid and save me on merchant fees?

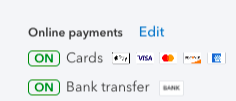

Yes, there are alternatives. If you use Quickbooks Online for your invoicing (which we highly recommend), you can enable electronic payment via Bank Transfer only. This is a much cheaper option – 1%, capped at $10. The only trade-off is that this CAN take longer than credit card payments. That’s the trade-off – higher fees tend to guarantee quicker availability of funds in your account. More info is here.

I tend to think we want to remove as much friction as we can for our customers when it comes to them paying their bills. As small business owners, we also want to shorten the time between service/product delivery and when we have access to that precious cash. You’ll need to make decisions about this that suit your business, your customers and your overall financial situation. If I can help, let me know!

*Anything that shortens the time between when you’ve delivered and when you have your money EXCEPT Venmo, unless you’re using the bonafide Venmo for Business, not trying to avoid fees by pretending people are your friends and family sending you money via your personal Venmo. Please don’t.